Extra material: Optimal Growth Portfolios with Risk Aversion#

Among the reasons why Kelly was neglected by investors were high profile critiques by the most famous economist of the 20th Century, Paul Samuelson. Samuelson objected on several grounds, among them is a lack of risk aversion that results in large bets and risky short term behavior, and that Kelly’s result is applicable to only one of many utility functions that describe investor preferences. The controversy didn’t end there, however, as other academic economists, including Harry Markowitz, and practitioners found ways to adapt the Kelly criterion to investment funds.

This notebook presents solutions to Kelly’s problem for optimal growth portfolios using exponential cones. A significant feature of this notebook is the inclusion of a risk constraint recently proposed by Boyd and coworkers. These notes are based on recent papers such as Cajas (2021), Busseti, Ryu and Boyd (2016), Fu, Narasimhan, and Boyd (2017). Additional bibliographic notes are provided at the end of the notebook.

# install dependencies and select solver

%pip install -q amplpy numpy pandas

SOLVER_CONIC = "mosek" # ipopt, mosek, knitro

from amplpy import AMPL, ampl_notebook

ampl = ampl_notebook(

modules=["coin", "mosek"], # modules to install

license_uuid="default", # license to use

) # instantiate AMPL object and register notebook magic

Financial Data#

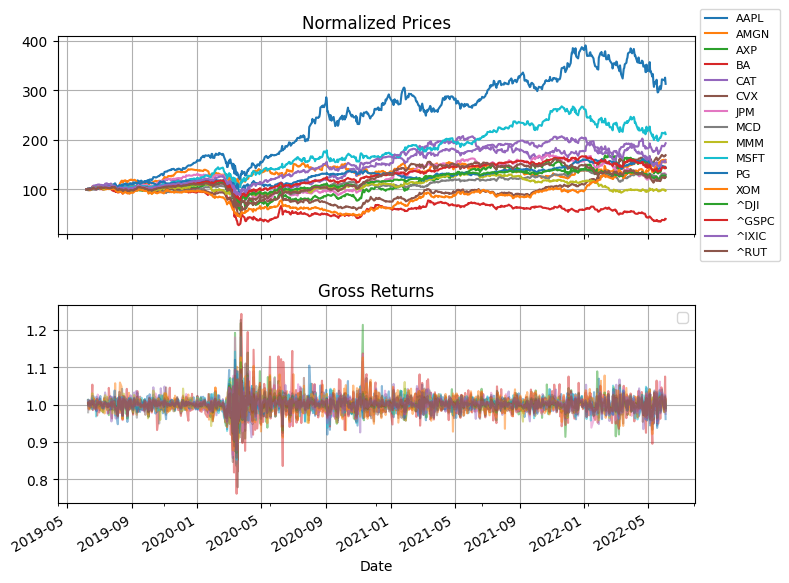

We begin by reading historical prices for a selected set of trading symbols using yfinance.

While it would be interesting to include an international selection of financial indices and assets, differences in trading and bank holidays would involve more elaborate coding. For that reason, the following cell has been restricted to indices and assets trading in U.S. markets.

# run this cell to install yfinance

%pip install yfinance --upgrade -q

import matplotlib.pyplot as plt

import numpy as np

import pandas as pd

import datetime

import yfinance as yf

# symbols as used by Yahoo Finance

symbols = {

# selected indices

"^GSPC": "S&P 500",

"^IXIC": "Nasdaq",

"^DJI": "Dow Jones Industrial",

"^RUT": "Russell 2000",

# selected stocks

"AXP": "American Express",

"AMGN": "Amgen",

"AAPL": "Apple",

"BA": "Boeing",

"CAT": "Caterpillar",

"CVX": "Chevron",

"JPM": "JPMorgan Chase",

"MCD": "McDonald's",

"MMM": "3 M",

"MSFT": "Microsoft",

"PG": "Proctor & Gamble",

"XOM": "ExxonMobil",

}

# years of testing and training data

n_test = 1

n_train = 2

# get today's date

today = datetime.datetime.today().date()

# training data dates

end = today - datetime.timedelta(int(n_test * 365))

start = end - datetime.timedelta(int((n_test + n_train) * 365))

# get training data

S = yf.download(list(symbols.keys()), start=start, end=end)["Adj Close"]

# compute gross returns

R = S / S.shift(1)

R.dropna(inplace=True)

[*********************100%***********************] 16 of 16 completed

# plot

fig, ax = plt.subplots(2, 1, figsize=(8, 6), sharex=True)

S.divide(S.iloc[0] / 100).plot(ax=ax[0], grid=True, title="Normalized Prices")

ax[0].legend(loc="center left", bbox_to_anchor=(1.0, 0.5), prop={"size": 8})

R.plot(ax=ax[1], grid=True, title="Gross Returns", alpha=0.5).legend([])

fig.tight_layout()

Portfolio Design for Optimal Growth#

Model#

Here we are examining a set \(N\) of financial assets trading in efficient markets. The historical record consists of a matrix \(R \in \mathbb{R}^{T\times N}\) of gross returns where \(T\) is the number of observations.

The weights \(w_n \geq 0\) for \(n\in N\) denote the fraction of the portfolio invested in asset \(n\). Any portion of the portfolio not invested in traded assets is assumed to have a gross risk-free return \(R_f = 1 + r_f\), where \(r_f\) is the return on a risk-free asset.

Assuming the gross returns are independent and identically distributed random variables, and the historical data set is representative of future returns, the investment model becomes

Note this formulation allows the sum of weights \(\sum_{n\in N} w_n\) to be greater than one. In that case the investor would be investing more than the value of the portfolio in traded assets. In other words the investor would be creating a leveraged portfolio by borrowing money at a rate \(R_f\). To incorporate a constraint on the degree of leveraging, we introduce a constraint

where \(E_M\) is the “equity multiplier.” A value \(E_M \leq 1\) restricts the total investment to be less than or equal to the equity available to the investor. A value \(E_M > 1\) allows the investor to leverage the available equity by borrowing money at a gross rate \(R_f = 1 + r_f\).

Using techniques demonstrated in other examples, this model can be reformulated with exponential cones.

For the risk constrained case, we consider a constraint

where \(\lambda\) is a risk aversion parameter. Assuming the historical returns are equiprobable

The risk constraint is satisfied for any \(w_n\) if the risk aversion parameter \(\lambda=0\). For any value \(\lambda > 0\) the risk constraint has a feasible solution \(w_n=0\) for all \(n \in N\). Recasting as a sum of exponentials,

Using the \(q_t \leq \log(R_t)\) as used in the examples above, and \(u_t \geq e^{- \lambda q_t}\), we get the risk constrained model optimal log growth.

Given a risk-free rate of return \(R_f\), a maximum equity multiplier \(E_M\), and value \(\lambda \geq 0\) for the risk aversion, risk constrained Kelly portfolio is given the solution to

The following cells demonstrate an AMPL implementation of the model with the Mosek solver.

AMPL Implementation#

The AMPL implementation for the risk-constrained Kelly portfolio accepts three parameters, the risk-free gross returns \(R_f\), the maximum equity multiplier, and the risk-aversion parameter.

%%writefile kelly_portfolio.mod

param Rf;

param EM;

param lambd;

# index lists

set T;

set N;

param Rloc{T, N};

# decision variables

var q{T};

var w{N} >= 0;

# objective

maximize ElogR:

sum {t in T} q[t] / card(T);

# conic constraints on return

var R{t in T}

= Rf + sum {n in N} w[n]*(Rloc[t, n] - Rf);

s.t. C{t in T}:

R[t] >= exp(q[t]);

# risk constraints

var u{T};

s.t. USum:

sum {t in T} u[t] / card(T) <= Rf**(-lambd);

s.t. RT{t in T}:

u[t] >= exp( -lambd*q[t] );

# equity multiplier constraint

s.t. WSum:

sum {n in N} w[n] <= EM;

Overwriting kelly_portfolio.mod

def kelly_portfolio(R, Rf=1, EM=1, lambd=0):

ampl = AMPL()

ampl.read("kelly_portfolio.mod")

ampl.param["Rf"] = Rf

ampl.param["EM"] = EM

ampl.param["lambd"] = lambd

# index lists

ampl.set["T"] = [str(t) for t in R.index]

ampl.set["N"] = [str(n) for n in R.columns]

ampl.param["Rloc"] = {

(str(t), str(n)): R.at[t, n]

for i, t in enumerate(R.index)

for j, n in enumerate(R.columns)

}

ampl.option["solver"] = SOLVER_CONIC

ampl.solve()

return ampl

def kelly_report(ampl):

# print report

s = f"""

Risk Free Return = {100*(np.exp(252*np.log(ampl.get_value('Rf'))) - 1):0.2f}

Equity Multiplier Limit = {ampl.get_value('EM'):0.5f}

Risk Aversion = {ampl.get_value('lambd'):0.5f}

Portfolio

"""

w = ampl.get_variable("w").to_dict()

Rvar = ampl.get_variable("R").to_dict()

s += "\n".join([f"{n:8s} {symbols[n]:30s} {100*w[n]:8.2f} %" for n in w.keys()])

s += f"""

{'':8s} {'Risk Free':30s} {100*(1 - sum(w[n] for n in w.keys())):8.2f} %

Annualized return = {100*(np.exp(252*ampl.get_value('ElogR')) - 1):0.2f} %

"""

print(s)

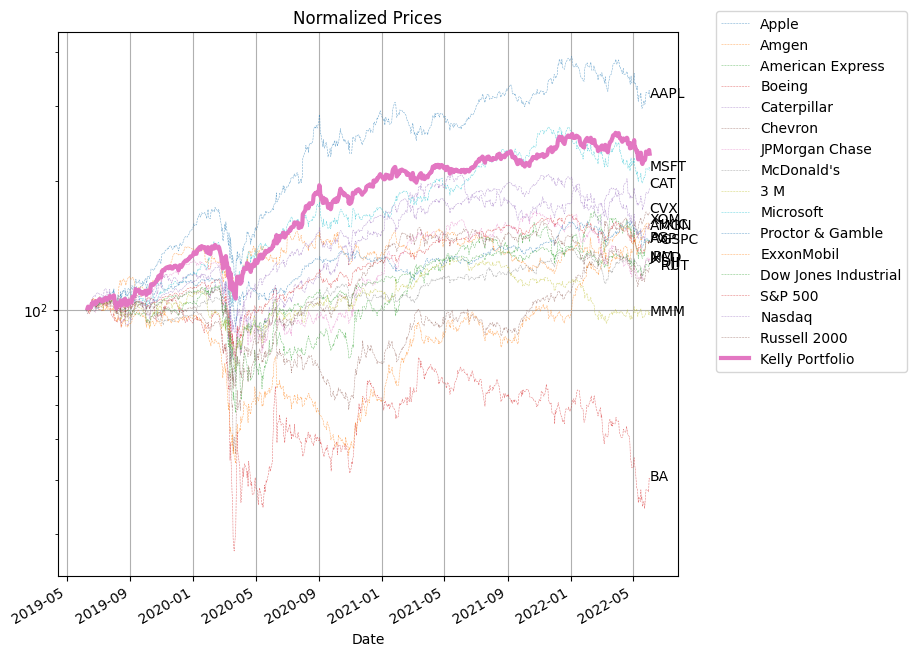

df = pd.DataFrame(

pd.Series([Rvar[str(t)] for t in R.index]), columns=["Kelly Portfolio"]

)

df.index = R.index ## original index are the DateTimeStamps

fix, ax = plt.subplots(1, 1, figsize=(8, 8))

S.divide(S.iloc[0] / 100).plot(

ax=ax,

logy=True,

grid=True,

title="Normalized Prices",

alpha=0.6,

lw=0.4,

ls="--",

)

df.cumprod().multiply(100).plot(ax=ax, lw=3, grid=True)

ax.legend(

[symbols[n] for n in R.columns] + ["Kelly Portfolio"],

bbox_to_anchor=(1.05, 1.05),

)

d = S.index[-1]

print(d)

for n in w.keys():

y = 100 * S[n].iloc[-1] / S[n].iloc[0]

print(n, 100 * S[n].iloc[-1] / S[n].iloc[0])

ax.text(d, y, n)

# parameter values

Rf = np.exp(np.log(1.0) / 252)

EM = 1

lambd = 10

m = kelly_portfolio(R, Rf, EM, lambd)

kelly_report(m)

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001115058867

0 simplex iterations

22 barrier iterations

Risk Free Return = 0.00

Equity Multiplier Limit = 1.00000

Risk Aversion = 10.00000

Portfolio

AAPL Apple 57.78 %

AMGN Amgen 0.00 %

AXP American Express 0.00 %

BA Boeing 0.00 %

CAT Caterpillar 18.97 %

CVX Chevron 0.00 %

JPM JPMorgan Chase 0.00 %

MCD McDonald's 0.00 %

MMM 3 M 0.00 %

MSFT Microsoft 0.00 %

PG Proctor & Gamble 0.00 %

XOM ExxonMobil 0.00 %

^DJI Dow Jones Industrial 0.00 %

^GSPC S&P 500 0.00 %

^IXIC Nasdaq 0.00 %

^RUT Russell 2000 0.00 %

Risk Free 23.25 %

Annualized return = 32.44 %

2022-06-03 00:00:00

AAPL 313.3368230987512

AMGN 154.57373693975774

AXP 143.59720714356118

BA 40.08344979462141

CAT 193.1338141274621

CVX 168.98770245792917

JPM 130.31933675829177

MCD 129.6343379131071

MMM 97.33192901788738

MSFT 211.75261984245606

PG 144.29053167324705

XOM 159.39669011089973

^DJI 126.61551678143734

^GSPC 142.9882963168018

^IXIC 155.1611360900202

^RUT 124.34379721298355

S.head()

| AAPL | AMGN | AXP | BA | CAT | CVX | JPM | MCD | MMM | MSFT | PG | XOM | ^DJI | ^GSPC | ^IXIC | ^RUT | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Date | ||||||||||||||||

| 2019-06-07 | 46.121952 | 155.557022 | 114.483406 | 347.400238 | 112.699974 | 101.451523 | 96.646111 | 187.392517 | 142.644150 | 126.295914 | 98.509666 | 60.087990 | 25983.939453 | 2873.340088 | 7742.100098 | 1514.390015 |

| 2019-06-10 | 46.711361 | 155.619110 | 115.948608 | 347.498413 | 113.859032 | 102.127975 | 97.690834 | 183.580475 | 144.082504 | 127.449310 | 98.464378 | 60.353874 | 26062.679688 | 2886.729980 | 7823.169922 | 1523.560059 |

| 2019-06-11 | 47.252258 | 154.768219 | 116.487427 | 343.108063 | 115.253525 | 101.192619 | 97.991859 | 185.367935 | 144.613327 | 126.968742 | 99.062119 | 60.297466 | 26048.509766 | 2885.719971 | 7822.569824 | 1519.109985 |

| 2019-06-12 | 47.101887 | 155.636841 | 115.353081 | 340.849030 | 115.090538 | 100.374207 | 96.743507 | 186.890930 | 144.698929 | 126.382423 | 99.333824 | 59.644863 | 26004.830078 | 2879.840088 | 7792.720215 | 1519.790039 |

| 2019-06-13 | 47.092175 | 156.620621 | 115.192368 | 342.646423 | 115.153931 | 100.975510 | 96.982559 | 186.489700 | 144.561996 | 127.180168 | 100.447807 | 60.168556 | 26106.769531 | 2891.639893 | 7837.129883 | 1535.800049 |

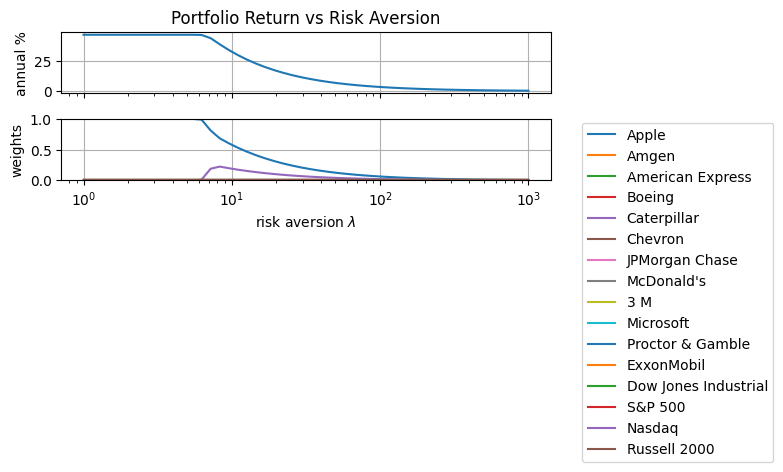

Effects of the Risk-Aversion Parameter#

lambd = 10 ** np.linspace(0, 3)

results = [kelly_portfolio(R, Rf=1, EM=1, lambd=_) for _ in lambd]

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001514729021

0 simplex iterations

12 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001514730217

0 simplex iterations

11 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001514731433

0 simplex iterations

12 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001514732444

0 simplex iterations

12 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001514732116

0 simplex iterations

13 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001514731363

0 simplex iterations

13 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001514730112

0 simplex iterations

13 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001514731633

0 simplex iterations

13 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001514732135

0 simplex iterations

14 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001514730977

0 simplex iterations

14 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.00151473216

0 simplex iterations

19 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001514731721

0 simplex iterations

18 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001514732466

0 simplex iterations

22 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001510090893

0 simplex iterations

24 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001437622267

0 simplex iterations

27 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001295714115

0 simplex iterations

21 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001158395522

0 simplex iterations

21 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001032061346

0 simplex iterations

21 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.000916678938

0 simplex iterations

36 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.0008119779914

0 simplex iterations

22 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.0007174855375

0 simplex iterations

29 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal, stalling; objective 0.0006326317078

0 simplex iterations

57 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.0005567612961

0 simplex iterations

68 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal, stalling; objective 0.000489173801

0 simplex iterations

46 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.0004291643027

0 simplex iterations

23 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.0003760314216

0 simplex iterations

30 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.0003291057879

0 simplex iterations

23 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal, stalling; objective 0.0002877495441

0 simplex iterations

49 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.0002513785857

0 simplex iterations

46 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal, stalling; objective 0.0002194350789

0 simplex iterations

43 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal, stalling; objective 0.0001914243691

0 simplex iterations

39 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal, stalling; objective 0.0001668951972

0 simplex iterations

104 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal, stalling; objective 0.0001454355608

0 simplex iterations

34 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal, stalling; objective 0.0001266777712

0 simplex iterations

61 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal, stalling; objective 0.0001102993894

0 simplex iterations

50 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 9.601835593e-05

0 simplex iterations

51 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal, stalling; objective 8.353869664e-05

0 simplex iterations

54 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal, stalling; objective 7.267431243e-05

0 simplex iterations

120 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal, stalling; objective 6.320673287e-05

0 simplex iterations

74 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal, stalling; objective 5.496267527e-05

0 simplex iterations

81 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 4.780118333e-05

0 simplex iterations

121 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 4.15554229e-05

0 simplex iterations

95 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 3.612044892e-05

0 simplex iterations

119 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal, stalling; objective 3.137887756e-05

0 simplex iterations

244 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal, stalling; objective 2.726071662e-05

0 simplex iterations

197 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal, stalling; objective 2.368800934e-05

0 simplex iterations

294 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 2.059797531e-05

0 simplex iterations

168 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 1.789750665e-05

0 simplex iterations

123 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 1.555107149e-05

0 simplex iterations

242 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal, stalling; objective 1.349274934e-05

0 simplex iterations

200 barrier iterations

import matplotlib.pyplot as plt

import numpy as np

fig, ax = plt.subplots(2, 1, figsize=(8, 4), sharex=True)

ax[0].semilogx(

[m.get_value("lambd") for m in results],

[100 * (np.exp(252 * m.get_value("ElogR")) - 1) for m in results],

)

ax[0].set_title("Portfolio Return vs Risk Aversion")

ax[0].set_ylabel("annual %")

ax[0].grid(True)

ax[1].semilogx(

[m.get_value("lambd") for m in results],

[

[w[str(n)] for n in R.columns]

for m in results

for w in [m.get_variable("w").to_dict()]

],

)

ax[1].set_ylabel("weights")

ax[1].set_xlabel("risk aversion $\lambda$")

ax[1].legend([symbols[n] for n in R.columns], bbox_to_anchor=(1.05, 1.05))

ax[1].grid(True)

ax[1].set_ylim(0, EM)

fig.tight_layout()

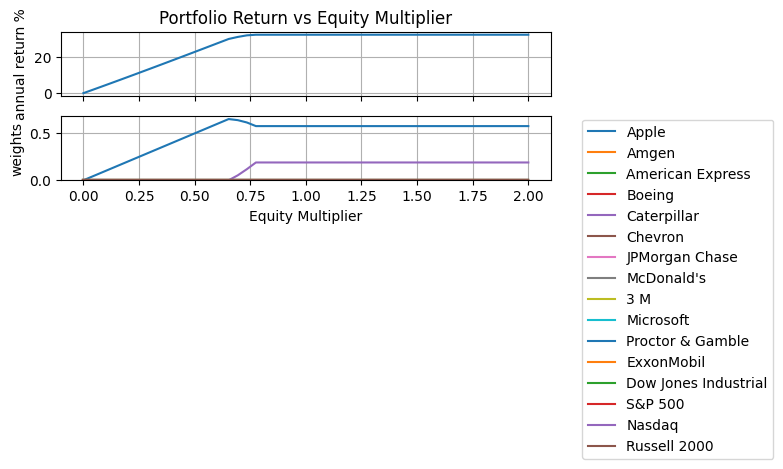

Effects of the Equity Multiplier Parameter#

EM = np.linspace(0.0, 2.0)

results = [kelly_portfolio(R, Rf=1, EM=_, lambd=10) for _ in EM]

MOSEK 10.0.43: MOSEK 10.0.43: unknown (0, problem status: 0), max number of iterations reached

0 simplex iterations

400 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 7.127764616e-05

0 simplex iterations

15 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.0001417540358

0 simplex iterations

13 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.0002114242562

0 simplex iterations

12 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.0002802885279

0 simplex iterations

12 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.0003483468736

0 simplex iterations

12 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.0004156018916

0 simplex iterations

13 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.0004820568272

0 simplex iterations

14 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.0005477046862

0 simplex iterations

14 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.0006125490061

0 simplex iterations

15 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.0006765882375

0 simplex iterations

15 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.000739824828

0 simplex iterations

18 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.0008022547016

0 simplex iterations

21 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.0008638806781

0 simplex iterations

20 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.0009247042986

0 simplex iterations

22 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.0009847215819

0 simplex iterations

22 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001043934055

0 simplex iterations

25 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001078172194

0 simplex iterations

29 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001104816542

0 simplex iterations

27 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.00111506199

0 simplex iterations

21 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001115066018

0 simplex iterations

23 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.00111506275

0 simplex iterations

21 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001115058768

0 simplex iterations

27 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001115062686

0 simplex iterations

25 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001115058794

0 simplex iterations

60 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001115064775

0 simplex iterations

22 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001115059022

0 simplex iterations

24 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001115061998

0 simplex iterations

20 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001115064832

0 simplex iterations

21 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001115063757

0 simplex iterations

20 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001115062221

0 simplex iterations

20 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001115062519

0 simplex iterations

24 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001115063848

0 simplex iterations

23 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001115063227

0 simplex iterations

22 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001115061374

0 simplex iterations

30 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001115059603

0 simplex iterations

24 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001115060952

0 simplex iterations

24 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001115058514

0 simplex iterations

39 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001115060287

0 simplex iterations

18 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.0011150608

0 simplex iterations

22 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001115060207

0 simplex iterations

33 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001115064884

0 simplex iterations

22 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001115064279

0 simplex iterations

31 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001115061648

0 simplex iterations

21 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001115062476

0 simplex iterations

19 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001115058494

0 simplex iterations

23 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001115061564

0 simplex iterations

19 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001115063624

0 simplex iterations

22 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001115060886

0 simplex iterations

19 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001115060828

0 simplex iterations

21 barrier iterations

import matplotlib.pyplot as plt

import numpy as np

fig, ax = plt.subplots(2, 1, figsize=(8, 4), sharex=True)

ax[0].plot(

[m.get_value("EM") for m in results],

[100 * (np.exp(252 * m.get_value("ElogR")) - 1) for m in results],

)

ax[0].set_title("Portfolio Return vs Equity Multiplier")

ax[0].set_ylabel("annual return %")

ax[0].grid(True)

ax[1].plot(

[m.get_value("EM") for m in results],

[

[w[str(n)] for n in R.columns]

for m in results

for w in [m.get_variable("w").to_dict()]

],

)

ax[1].set_ylabel("weights")

ax[1].set_xlabel("Equity Multiplier")

ax[1].legend([symbols[n] for n in R.columns], bbox_to_anchor=(1.05, 1.05))

ax[1].grid(True)

ax[1].set_ylim(

0,

)

fig.tight_layout()

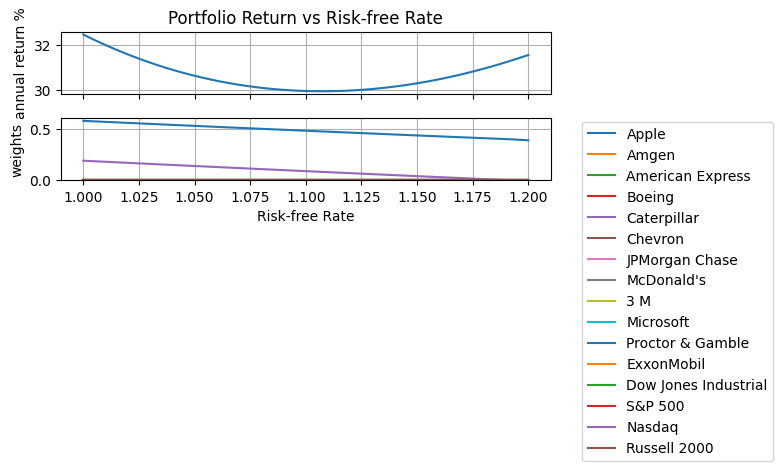

Effect of Risk-free Interest Rate#

Rf = np.exp(np.log(1 + np.linspace(0, 0.20)) / 252)

results = [kelly_portfolio(R, Rf=_, EM=1, lambd=10) for _ in Rf]

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001115058867

0 simplex iterations

22 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001109229733

0 simplex iterations

21 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001103644806

0 simplex iterations

21 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001098315886

0 simplex iterations

22 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001093231488

0 simplex iterations

25 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001088400657

0 simplex iterations

19 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001083803179

0 simplex iterations

20 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001079457309

0 simplex iterations

23 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001075345323

0 simplex iterations

23 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001071468947

0 simplex iterations

20 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001067825963

0 simplex iterations

19 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001064420867

0 simplex iterations

20 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001061247108

0 simplex iterations

19 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001058296152

0 simplex iterations

20 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001055577603

0 simplex iterations

21 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001053077952

0 simplex iterations

21 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001050797566

0 simplex iterations

21 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001048747589

0 simplex iterations

20 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001046908631

0 simplex iterations

20 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001045285188

0 simplex iterations

24 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001043880982

0 simplex iterations

23 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001042686638

0 simplex iterations

21 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001041703608

0 simplex iterations

22 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001040928355

0 simplex iterations

45 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001040359883

0 simplex iterations

23 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001040000051

0 simplex iterations

26 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.00103984141

0 simplex iterations

22 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001039879451

0 simplex iterations

23 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001040122591

0 simplex iterations

26 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001040556867

0 simplex iterations

45 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001041194597

0 simplex iterations

27 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001042019612

0 simplex iterations

29 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001043041453

0 simplex iterations

28 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001044258079

0 simplex iterations

33 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001045652626

0 simplex iterations

29 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001047237922

0 simplex iterations

22 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001049012414

0 simplex iterations

24 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001050967859

0 simplex iterations

24 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001053110487

0 simplex iterations

22 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001055426877

0 simplex iterations

24 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001057925246

0 simplex iterations

23 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal, stalling; objective 0.00106060001

0 simplex iterations

30 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001063452812

0 simplex iterations

39 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001066479571

0 simplex iterations

40 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001069678622

0 simplex iterations

32 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001073048927

0 simplex iterations

27 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001076589141

0 simplex iterations

26 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001080298143

0 simplex iterations

25 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001084143277

0 simplex iterations

22 barrier iterations

MOSEK 10.0.43: MOSEK 10.0.43: optimal; objective 0.001088103524

0 simplex iterations

39 barrier iterations

import matplotlib.pyplot as plt

import numpy as np

fig, ax = plt.subplots(2, 1, figsize=(8, 4), sharex=True)

Rf = np.exp(252 * np.log(np.array([_.get_value("Rf") for _ in results])))

ax[0].plot(Rf, [100 * (np.exp(252 * m.get_value("ElogR")) - 1) for m in results])

ax[0].set_title("Portfolio Return vs Risk-free Rate")

ax[0].set_ylabel("annual return %")

ax[0].grid(True)

ax[1].plot(

Rf,

[

[w[str(n)] for n in R.columns]

for m in results

for w in [m.get_variable("w").to_dict()]

],

)

ax[1].set_ylabel("weights")

ax[1].set_xlabel("Risk-free Rate")

ax[1].legend([symbols[n] for n in R.columns], bbox_to_anchor=(1.05, 1.05))

ax[1].grid(True)

ax[1].set_ylim(

0,

)

fig.tight_layout()

Extensions#

The examples cited in this notebook assume knowledge of the probability mass distribution. Recent work by Sun and Boyd (2018) and Hsieh (2022) suggest models for finding investment strategies for cases where the distributions are not perfectly known. They call them “distributionally robust Kelly gambling.” A useful extension to this notebook would be to demonstrate a robust solution to one or more of the examples.

Bibliographic Notes#

Thorp, E. O. (2017). A man for all markets: From Las Vegas to wall street, how i beat the dealer and the market. Random House.

Thorp, E. O. (2008). The Kelly criterion in blackjack sports betting, and the stock market. In Handbook of asset and liability management (pp. 385-428). North-Holland. https://www.palmislandtraders.com/econ136/thorpe_kelly_crit.pdf

MacLean, L. C., Thorp, E. O., & Ziemba, W. T. (2010). Good and bad properties of the Kelly criterion. Risk, 20(2), 1. https://www.stat.berkeley.edu/~aldous/157/Papers/Good_Bad_Kelly.pdf

MacLean, L. C., Thorp, E. O., & Ziemba, W. T. (2011). The Kelly capital growth investment criterion: Theory and practice (Vol. 3). world scientific. https://www.worldscientific.com/worldscibooks/10.1142/7598#t=aboutBook

Carta, A., & Conversano, C. (2020). Practical Implementation of the Kelly Criterion: Optimal Growth Rate, Number of Trades, and Rebalancing Frequency for Equity Portfolios. Frontiers in Applied Mathematics and Statistics, 6, 577050. https://www.frontiersin.org/articles/10.3389/fams.2020.577050/full

The utility of conic optimization to solve problems involving log growth is more recent. Here are some representative papers.

Cajas, D. (2021). Kelly Portfolio Optimization: A Disciplined Convex Programming Framework. Available at SSRN 3833617. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3833617

Busseti, E., Ryu, E. K., & Boyd, S. (2016). Risk-constrained Kelly gambling. The Journal of Investing, 25(3), 118-134. https://arxiv.org/pdf/1603.06183.pdf

Fu, A., Narasimhan, B., & Boyd, S. (2017). CVXR: An R package for disciplined convex optimization. arXiv preprint arXiv:1711.07582. https://arxiv.org/abs/1711.07582

Sun, Q., & Boyd, S. (2018). Distributional robust Kelly gambling. arXiv preprint arXiv: 1812.10371. https://web.stanford.edu/~boyd/papers/pdf/robust_kelly.pdf

The recent work by CH Hsieh extends these concepts in important ways for real-world implementation.

Hsieh, C. H. (2022). On Solving Robust Log-Optimal Portfolio: A Supporting Hyperplane Approximation Approach. arXiv preprint arXiv:2202.03858. https://arxiv.org/pdf/2202.03858